nebraska sales tax rate changes

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. LB 873 reduces the maximum tax rate of 684 for the income tax imposed on individuals and fiduciaries for taxable years beginning on or after January 1 2023.

Taxes And Spending In Nebraska

The Nebraska state sales and use tax rate is 55 055.

. Coleridge Nehawka and Wauneta will. The Nebraska state sales and use tax rate is 55 055. There is no applicable county tax or.

Beginning October 1 2002 Nebraska will have several alterations to their sales and use tax system. Nebraska Department of Revenue. 536 rows Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

There is no applicable county tax or. Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. The 65 sales tax rate in Chambers consists of 55 Nebraska state sales tax and 1 Chambers tax.

A new 1 local sales and use tax takes effect bringing the combined rate to 65. Nebraska has recent rate changes Thu Jul 01 2021. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

There are a total of 337 local tax jurisdictions across the state. The sales tax rate was originally going to be 55 up from 5 from October 1. This study recommended that business-to-business sales or business inputs be exempt a structural principle that still exists in todays law that is supported by economists as.

Changes in Local Sales and Use Tax Rates Effective January 1 2021. New local sales and use taxes. Nebraska sales tax rate changes July 2019.

Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from. Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments.

025 lower than the maximum sales tax in NE. 800-742-7474 NE and IA. January 2019 sales tax changes.

With local taxes the total sales tax rate is between 5500 and 8000. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. This is the total of state county and city sales tax rates.

The Nebraska sales tax rate is currently. The state sales tax rate in Nebraska is 5500. The Nebraska state sales and use tax rate is 55.

The minimum combined 2022 sales tax rate for Norfolk Nebraska is. 1 lower than the maximum sales tax in NE. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1 2021 updated 12032020.

Local sales and use tax increases to 2 bringing the. A new 1 local sales and use tax is being imposed in the. Motor Fuels Tax Rate.

The maximum tax rate for. 18 rows Over the past year there have been eighteen local sales tax rate changes in Nebraska. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

April 2019 sales tax changes. A new 05 local sales and use tax takes.

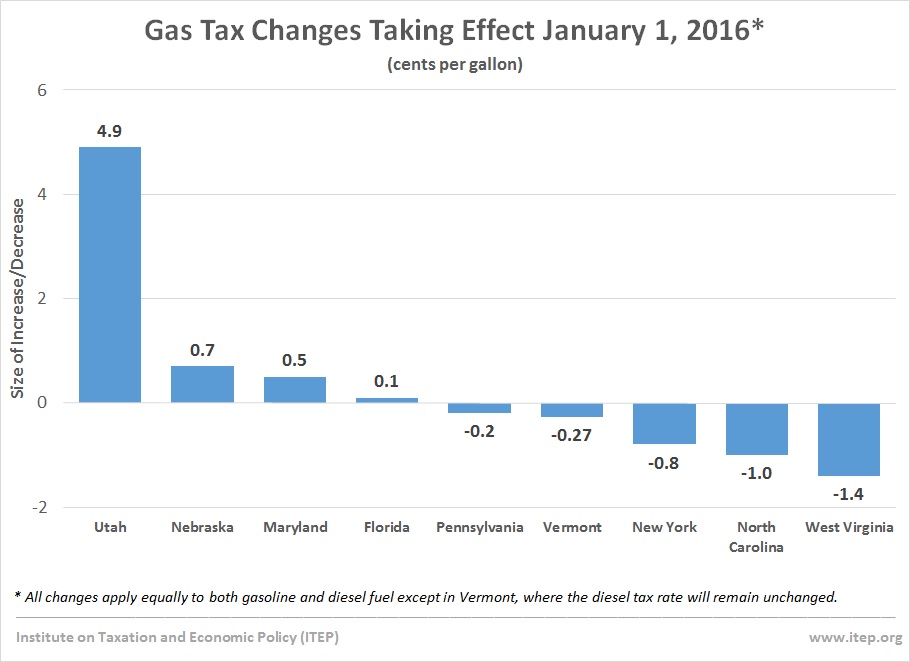

State Gas Tax Changes Up And Down Took Effect January 1 Planetizen News

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

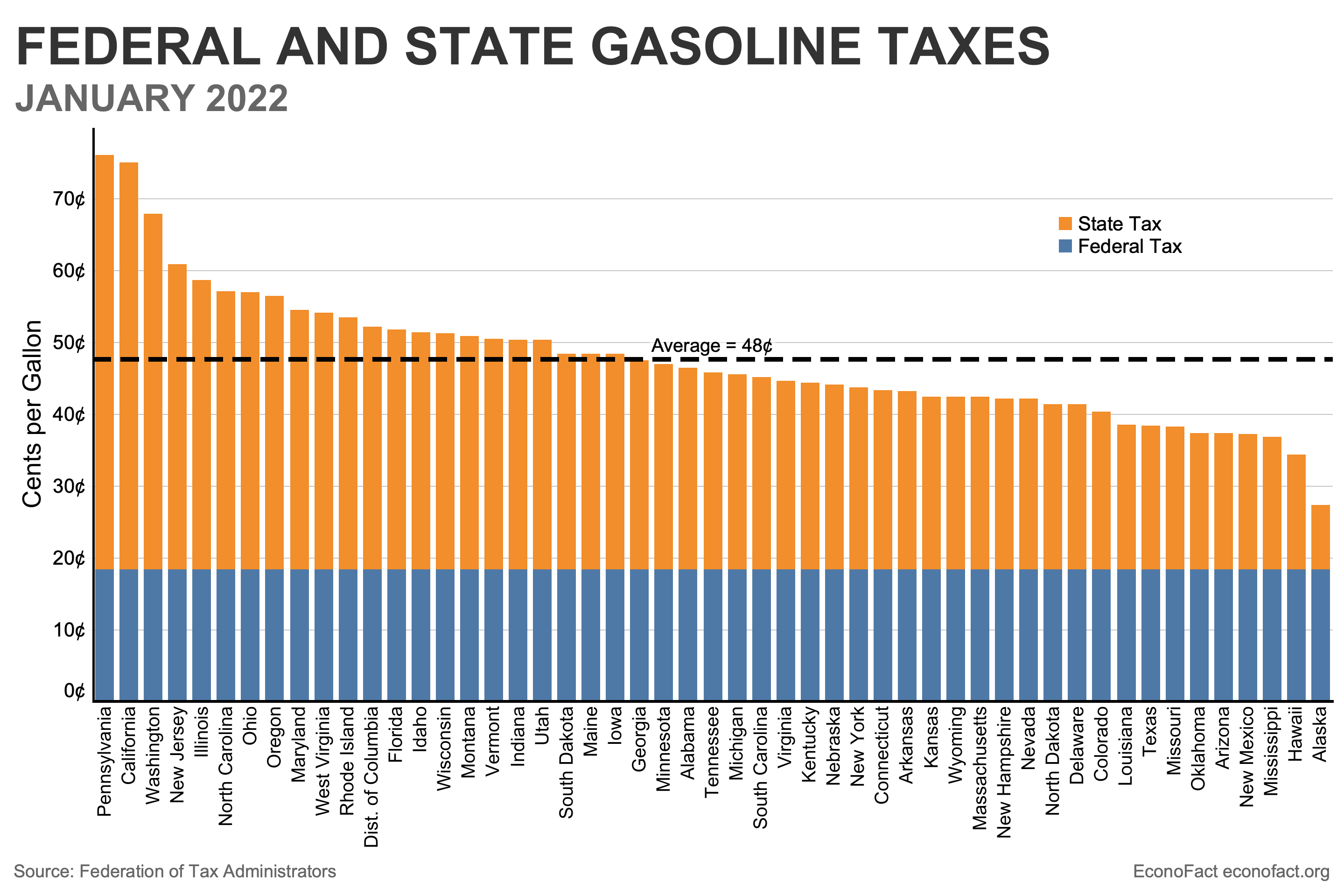

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Sales Tax By State Is Saas Taxable Taxjar

Nebraska Extends 2020 Tax Filing Deadline 3 Reasons You Might Need More Time

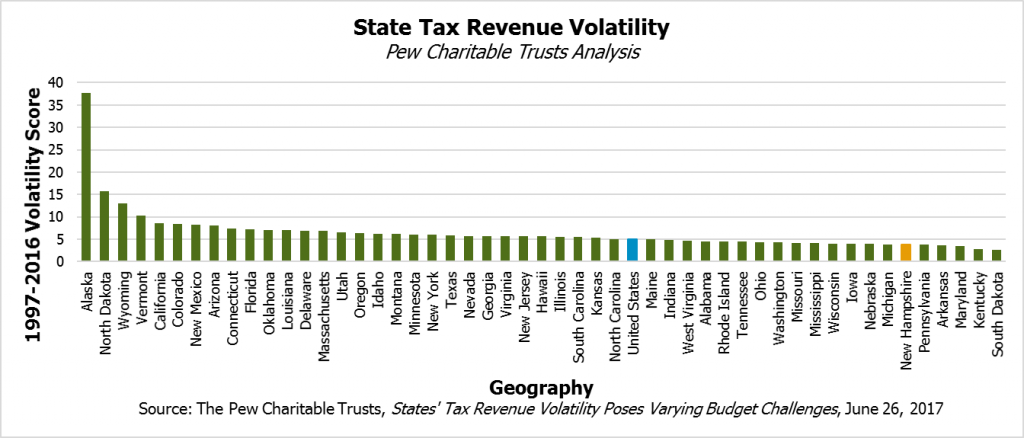

State S Diverse Tax Base Stabilizes Revenue But Business Tax Changes May Increase Volatility New Hampshire Fiscal Policy Institute

How To File And Pay Sales Tax In Nebraska Taxvalet

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Hitting The Gas 7 States Raise Fuel Taxes

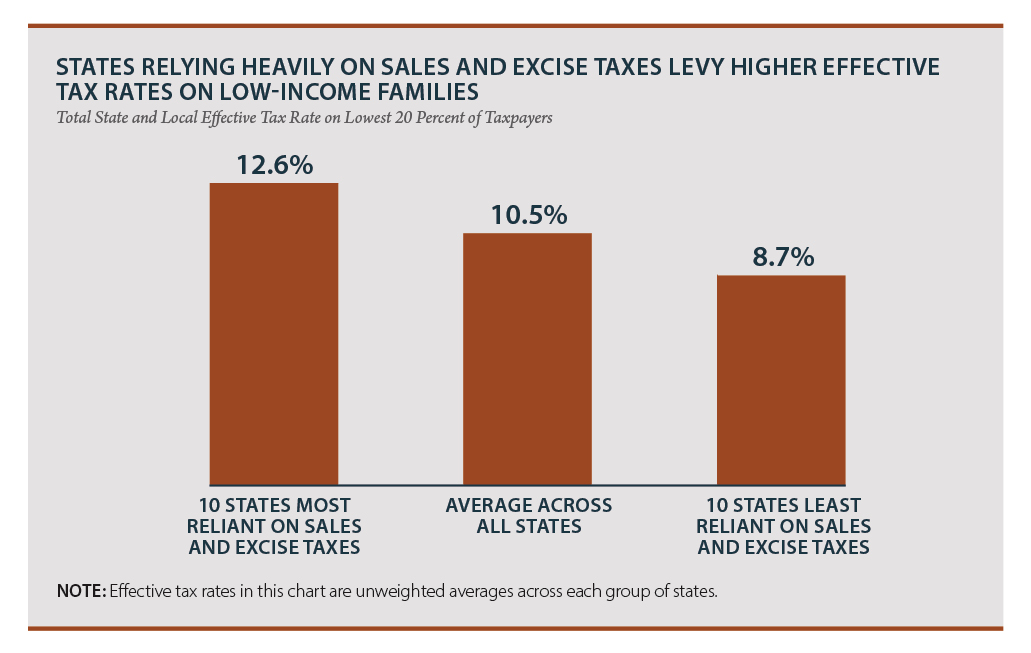

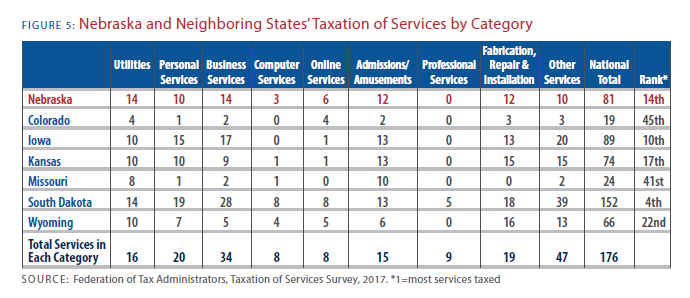

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

2020 Nebraska Property Tax Issues Agricultural Economics

Sales Taxes In The United States Wikipedia

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy